Leave a review on Apple Podcasts

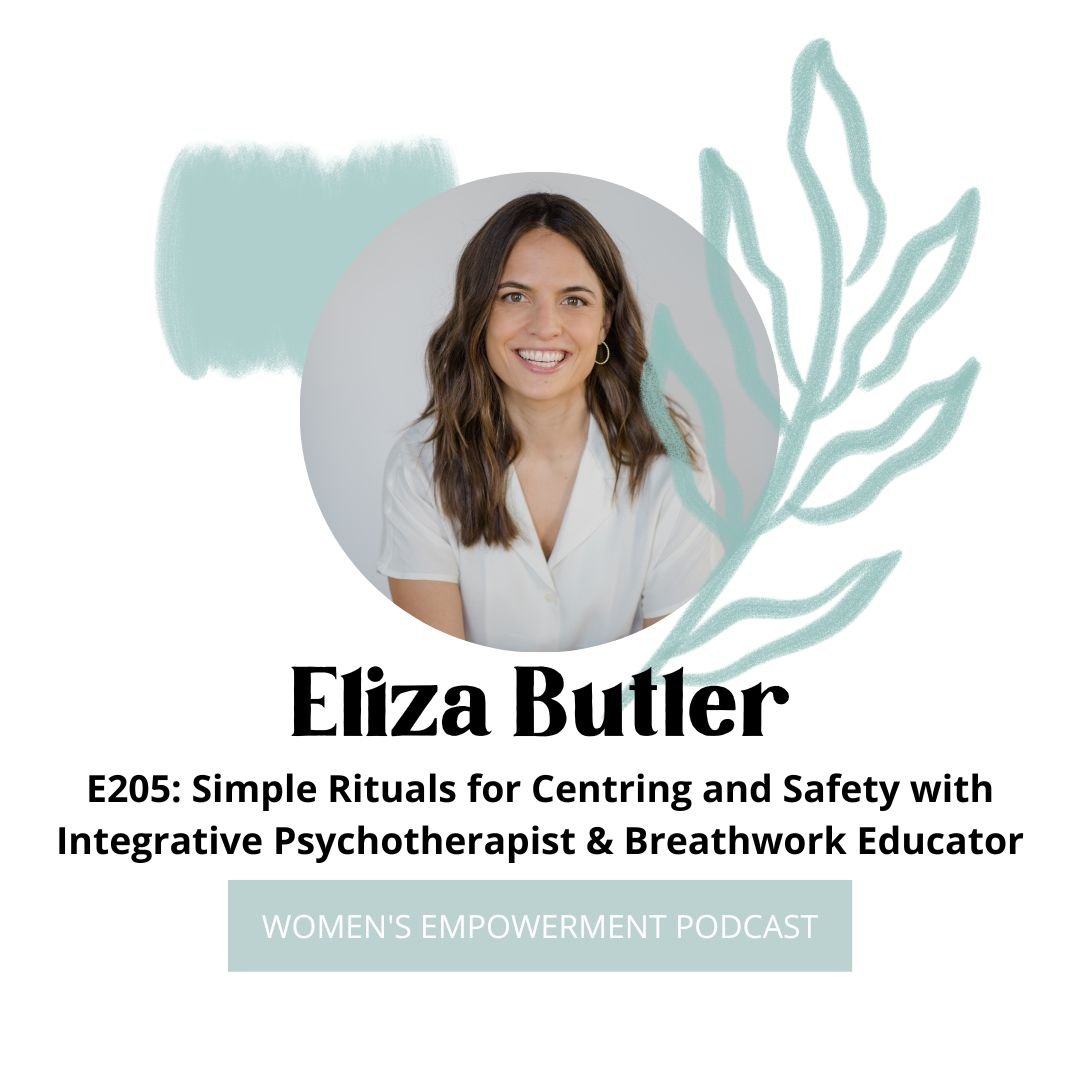

Valerie LaVigne: Lisa-Marie and her team specialize in holistic financial planning for those planning retirement. Those who are recently retired and those who have a growing business. They take a tailored approach with each client to develop a plan that is built specifically for them. Join me in welcoming Lisa-Marie Winning to the show.

Welcome back to the Women's Empowerment Podcast. I am very excited to introduce this special guest of our podcast today. This is Lisa Marie winning of Winning and Associates, and we are talking all about wealth today. So thank you, Lisa Marie, thank you so much for being here. This has been a long overdue conversation, but hey, we're finally doing.

Lisa-Marie Winning: I am so excited to be here. I have always hoped that you had asked me to be on this, so I feel very special and very welcome today. I love it. I feel like everything in its divine timing. Why don't we start with a little bit about who you are and what you do, and who you serve.

I am a holistic financial planner, and what that means is I help individuals, I help families, and I help business owners put together a roadmap that outlines and help. I help them to define what their goals are that. Like the timeframes that they want to achieve those goals in. And then I take a look at the big picture, the way that, you know, they earn their income what their habits are you know, the, the milestone moments that they have ahead.

And, and I put together a written plan, like a roadmap for them that outlines the very best way for them to work towards achieving their goals. And I think, you know, what is most important about that type of planning? It's important to remember, it's very dynamic. Our lives change and our, you know, our goals change, our families change, they grow.

And so a holistic financial plan is a dynamic document. So my, my job is to, you know, essentially be in a relationship with my clients and be there with them to constantly, you know, assist in updating that plan as they move through their life.

Valerie LaVigne: I love that. And full disclosure, Lisa Marie is my financial advisor, and I really do feel comfortable talking about all of this with you.

I feel like you do listen and there is this hand holding and there's this reassurance, but there's also this excitement for. What I wanna do with my goals or how I wanna see my future, and you make it feel possible to get there even when it feels really far away. So I just wanted to acknowledge you for that because I really appreciate that in our relationship.

And I know that oftentimes money can be this taboo conversation. And so I really admire the this holistic financial plan or this holistic approach to the finances and how you do that. And. Can you tell us a little bit more, like maybe break down that dynamicism, is that a word? The dynamics of your holistic financial plan?

Lisa-Marie Winning: Well, I think you made a very good point and, and I would say it's cultural. Like in Canada talking about money has always been taboo. If you go back, you know, generations, it's, we were always taught not, not to talk about money, not to ask about money is very private and I think what happens is it. It becomes part of your nature.

And so it translates to being afraid to ask questions or feeling like you haven't done all the right things yet. So you might be judged if you reach out and, and, you know, try to seek advice. So it, it's, maybe that's where I'd like to start and just to say like, think. It's, we have to change that.

That's, we have to unwind that culture and we have to make it a comfortable environment. We have to make people, you know, look forward to those types of conversations and learning and improving financial literacy, because the earlier you do that and the, the more comfortable you are being open and working with, you know, with professionals.

Professional advice. I can tell you I see it. It's those clients, the earlier they start and the more that they wanna learn. And most important. To be able to be open to taking advice. They're the ones that get, that, achieve those goals on track. They, they are further ahead when I look at them 10 years later, 15 years later.

And so I think that, you know, I always open my conversations up with, with new clients to say, let's just talk. Let's get to know each other. Let's take all the guards down and it's full transparency and let them. Anything they want, they wanna know about me personally, they wanna understand what the process looks like, what does it cost?

Let's, let's get it all out on the open in that first conversation. And then it's. Really the, the end of it, the feedback I get is, ugh, I'm so relieved and I'm so excited because it's kind of taken all that pressure and that anxiety and removed it and, you know, created this, this environment to be able to move forward and achieve really exciting things.

Valerie LaVigne: Yeah, I think you made a lot of great points with people being. I think the nervousness or the resistance comes from not knowing and not having that information and not having that financial literacy. And so when we don't know about something, we start to fill in the gaps with what we think or what we've heard or, you know, just make up a story and, and really you're just getting tied up with the fears of it.

So I guess one of my questions for you is what are some of those common misconceptions that we can maybe. Say that they're myths or how can we rewrite the, that mental block or that mindset block of it?

Lisa-Marie Winning: Well, definitely I would say there is a financial advisor or financial planner out there for everyone.

There are advisors who love working with. Young individuals, young entrepreneurs you know, people who are maybe close in age to those younger advisors. And I think that's important to remember is like you wanna work with somebody who has had. Similar experiences to you who has kind of, that is going to grow with you?

And so, you know, one of the biggest misconceptions is I don't have any money yet. And so I should just avoid seeking advice altogether until I have some, and I, I disagree. I think that, It's just a matter of finding the right advisor who specializes in working with individuals who are, you know, excited to start that process.

You know, for us where, where we have those types of relationships in our practice are with our, our clients' children. They're coming of age, they're graduating, and you know, It's, they, maybe they don't wanna take advice from their parents because they're still, you know, that the family dynamic still exists.

And so, you know, I have someone on our team that specializes, he's younger than me. He's, you know, on, you know, just started a young family but has all the credentials and the experience to be able to work with. With younger people and they feel comfortable with him because they can relate. And so that would be misconception number one is thinking.

It's not the right time to start. There's nobody ever that has ever looked back and said, Ugh, I started way too early. That's, you know, and I think you and I talk about that too, is, you know, you were really young when we started to work together, but we had like this milestone conversation about a big goal that you had that you achieved way earlier than.

We initially planned. And, and that's, I think that's a testament to setting your goals, sharing them with someone, and creating good habits to be able to, you know, expedite the, the, the path to achieve them.

Valerie LaVigne: Totally. I have like a little bit teary-eyed because it's so true. I know. I'm like, what? We're talking about money and I'm getting emotional.

It's so true. Like I didn't even realize how young I was. I was just a baby and. It was really scary, but like I didn't have anyone to really talk to and I def, I certainly wasn't gonna be talking to my parents about it. But yeah, that's really cool. And even just to look back now and think like, oh my gosh, yeah, I did take that leap.

And even though it was scary and I remember that conversation with you was super intimidating, but it was also really helpful. And I mean, look where we are now, right? And, and. Definitely reaching those goals. It feels so good and to know that there is a plan and there is a path, and there are things I can do today to help me for that tomorrow.

I love that. I love what you said. I'm like, no one said, oh, I, I started too early.

Lisa-Marie Winning:Exactly.

Valerie LaVigne: Of course stuff no one says. Yeah, I mean, that's a huge misconception. I feel like that's a great way to start is just go in. You know, meet different people in the, the industry and see who you connect with and start from there.

When it comes to those, maybe it's not misconceptions, but maybe it's more like mistakes or you know, things we wish we did differently as women. When it comes to money management, when it comes to financial decisions, what are some of the things you see maybe like over the decade, so beyond twenties and beyond?

Lisa-Marie Winning: So this is a very interesting one, this is my 27th year in my profession, so I have almost three decades to be able to go back and look at the evolution. And what I can tell you is that right off the bat, my, my top 10 biggest clients, a disproportionate number of them are female. And I think that's really interesting because 30 years ago or 27 years ago, that was not the case at all.

And so I think what I'd like to see more of, now that I know that that's, and, and that's, that's a, that's happening in our society, right? Over 80% of households, the female is the primary decision maker. Not to say that they're the so decision maker, but they're you. They're actively involved in doing a lot of the research and have taken on that role and that responsibility within a household.

So I would say for younger women you know, I'd like to see that, you know, you wanna, you wanna see them kind of follow that same path. So I would say one of the biggest mistakes is not getting involved. So even though when I look at, you know, my, those, those females I was chatting with, now I. If they are a business owner or if they are in a partnership the other person is in, has been involved.

But you know, the, and, and part of the process. But generally speaking, there's somebody who takes them more interest in it. The one that responds, sets the meetings, does the follow up. So I would say if you are in a relationship or you're in a partnership, like getting involved, being aware, feeling comfortable, maybe you're not the driver, but you know, you want to be able to work with somebody who you feel that at any moment you can pick up the phone and ask a question that you feel comfortable in the room, that you're included in the conversation, included in the process.

And then once you've done that and you've established that relationship and there's a good fit, you don't have to be. Like I said, you don't have to be the lead in that, in that relationship with your advisor, but it's important that from the very beginning you are part of that process. I never if I'm working with a couple, I would never go through the process of putting a financial plan together unless both parties were there because those, those individuals.

They're, they're not making, that, they're not, they're not individuals when those decisions are going to be executed. And when they're gonna reach those milestone moments, they're doing that together. And so if one person's beliefs and views and kind of thought process on how something should go, if they're the one that's driving like the, the financial plan and the other person's not present.

It never works out. We ultimately have to kind of reconvene, start all over again and build something that's con conducive to the both of them. Once that plan's in place. It's really simple. There's, it's not time consuming after we've done that. So I would say that's, that's something that I, I really strongly encourage is make sure that you're involved in the very beginning, even though you might not be interested or be the kinda leader in, in in that relat.

And I say relationship, not in like the couple relationship in the relationship with the advisor.

Valerie LaVigne: Mm-hmm. Mm-hmm. Yeah. I love that. It's a great, it's a great place like we were saying to start, but then also to move forward from there. Now when I think of where I was when we met, There was student debt, there was maybe a lack of clarity.

And then now kind of moving into my thirties, now I have different goals and, you know, I have a little bit more of a plan in place. I've reached some of the, the past goals I am now building on top of those. My question is for people who are either still in debt or trying to save for their future, while building a family, while trying to buy a home, how is, how can we manage all these things?

How can we do it all where we're thinking of our present, focusing on the present, the future, and then also maybe dealing with the past as well?

Lisa-Marie Winning: That's a really good question, and it's actually so timely to be able to talk about this because I think the most important answer to that is, It's not a one size fits all answer, and it's not a one answer for all of time.

So three years ago when we were at historically low interest rates And low inflation. I would say that was an opportune time and we've had, that was, you know, long stretch of, you know, low interest rates, low inflation, strong markets a good labor market, so lots of job security that, that was a, we experienced that for a very long time in Canada.

That's the type of timing where you really can tick a lot of box. You can pay down debt you can have money left over for savings. You can manage your cash flow effectively. And so in an environment like that, I'm gonna help someone kind of look at all the, you know, all those boxes and say, okay, if we're working with X number of dollars each month, here's how we should allocate.

And you, you can't accomplish more in the, in that type of environment. But here we are sitting, you know, the first quarter of 2023. We, you know, although inflation is steadily declining, it's still very high relative to where it has been, which. As a result of the some of the measures that were put in place to look after people during the, the pandemic.

Interest rates are, you know, much higher than we've seen in many people's lifetime. Not everyone, but some of the younger people that are gonna be listening to this definitely haven't lived through interest rates at the levels that they're at right now. And again, that's, you know, kind of unwinding some of the support that was in place for 2020, 2021.

That's where you really have to go back and revisit that, you know how that pie is allocated. And so if you have that same, you know, amount of money each month, I'm now changing the recommendation as to how to distribute it. Because let's say it was, if you, you know, want to focus on paying down debt and saving too, like really simple, like I'm, I'm oversimplifying it now.

We may have split. Those dollars up equally three years ago. But for the time being for 2022, 2023, and probably into 2024, I'm going to wanna shift more dollars towards debt reduction if that debt is tied to floating interest rates, or if you've taken on debt since interest rates have been higher.

Because if you don't make that adjustment, you're probably not like most of that money. It's just going towards interest and it's almost wasted. You're not paying down the principles. So I think it's important, and I came back to that point about it being dynamic. Your environment that you're in is going to, you know, dictate some of the decisions that have to be made.

So you can't just have a set it in, forget it approach. You really have to have, you know, circle back when your advisor reaches out for that meeting. Take the meeting, have the conversation and you know, you know, take the advice and make those tweaks because you will be further ahead and. I expect we'll see interest rates at the end of 2024, much lower than they are now again.

So that's when I'm gonna reach out to those clients, say, let's come back to the table and let's realign our goals and how we're making those allocations. And, and you know, if you do that, you, when we look at the outcome by making those adjustments over time we're gonna be further ahead when things normalize.

Valerie LaVigne: Hmm. So interesting, and this is one of the reasons why I love that we have this relationship because I don't know anything about all of this changing stuff that's happening, so I'm so glad that you can reach out to me.

Lisa-Marie Winning: But that's why having an advisor like advice, right? You know, when I need legal advice, I don't just go online and try to come up with that myself.

There are people who are professionals educated, who have the, you know, gone to school. Of course, I'm gonna reach out and have, you know, and seek that advice and, you know, I will be better off in the long run. It's no different when it comes to financial planning. And it's unfortunate because that's, this is one of the topics that I feel like everybody feels.

There's always an expert somewhere that is almost like a self-made expert or you get little glimpses of like commercials on television and they're eyecatching and we spend a lot of time when we're bringing clients into the practice, almost unwinding some of those bad habits or unwinding a lot of those misconceptions that you get in those like headlines or like tidbits of information.

And kind of going back to the basics and, and, you know, reeducating so that they feel comfortable. Taking that advice and making those adjustments.

Valerie LaVigne: Mm-hmm. I see this all the time on Instagram and TikTok, where it's like, you know this really enthusiastic person behind the camera explaining how you need to do this or you need to do that and the market is changing and this is this, but then I also don't even know where this person is located.

Is this relevant to the market that I'm in or the market that I'm investing in? I don't know. And it was a 15 second video. How much can you really understand? And there's no opportunity to ask questions or open to dialogue. So really having. An actual expert to talk to is really helpful. And some of the things you mentioned make me think of, you know, different milestones in our lives.

So speaking to that holistic financial plan, you know, when are we drawing up that plan? How often are we revisiting it? Maybe it's the market, but are there other times in our life when we wanna be doing that?

Lisa-Marie Winning: Yes, definitely. So I'll start by. And I'm, I hope that this continues to improve. But right now most people have this like aha moment or like a light bulb goes off.

And I would say I was to categories that I would say like between 35 and 45. And they wake up one day and they have a job and they maybe have some savings programs through their employer and maybe they put some money aside because they were. Like open an account online, you know, maybe they're in a relationship or maybe they're married, or maybe they've had a child and they all of a sudden wake up and say, oh my gosh, like I, I, I've done some stuff.

I've ticked some of those boxes, but I don't know if I've made all the right decisions. So right now I'm seeing it, it's kind of in that 10 year age bracket. Again, I hope that to, to our point that earlier that you start this, the better. But those, there's a lot of milestones that happen in your thirties and forties.

And so your plan, you know, the plan that you built so that we built together, your life circumstances look very different now than they did then. And so we, you know, we review that plan every single year and in a lot of cases, It is status quo and maybe some tax laws have changed, or you know, maybe some things happen with a job and there's a little bit more cash flow, and so we make some minor tweaks, but the major milestones as you're moving through your thirties and your forties and your fifties really have to do with your job or your business if you're a business owner and how that's growing.

And whether or not we need to, you know, look at the structure of your business or how you're paying yourself. And then from a family perspective, it's are you entering into a relationship? Are you co-mingling assets with someone else? Are you having children or adopting children? And what are your goals?

For your family. And so those, you know, there's like a kind of 20, 25 year period where the material changes are at their highest. That's when you're kind of moving and shaking and, and you've got people to, that you're caring for and looking after. So I would say that I see a lot of material changes being required.

Annually when we update those plans during that time period. And then it does, it does slow down a little bit because we've been kind of ramping up, you know, with take care of children, educate children, get ready for retirement, and then you kind of get to this place where, you know, children are taken care of.

You've probably got five to 10 years left of your max income earning potential, where we're really focusing on just that one goal, which is retirement. And then you get there, you get to enjoy it, you get to. Become a spender again. You've accumulated and now you get to spend, and then you kind of transition into another stage where you might be a caregiver again, aging parents.

And so there's some lulls where I would say there's not that many material changes and it's just minor tweaks here and there, but there are some kind of peaks where it is important. To stay on top of this, to not put that financial plan in a drawer, so to speak. They're, they're digital obviously now, but you know, you, you gotta work it and you gotta work that plan and it, and, you know, ensure that it stays on pace with the way that your life is evolving.

Valerie LaVigne: Yeah, absolutely. And again, I just like, I keep listening and thinking, oh my God, thank God I have you in my life, because it's not my area of expertise. Although that the one year mark goes by really quickly, the milestone comes up really fast, like, I'm already 32. And again, I just, I didn't even realize how long ago it was that we met, that we were having that original conversation and how much has changed and 10 years seems like a long time, and then it doesn't at the same time.

It goes by actually really quickly. So yeah, that's, it's powerful and it's really important information and I'm really glad that we're, we're having this conversation. So thank you so much for all this incredible knowledge. Is there anything. Hasn't been said today that you really wanna share?

Lisa-Marie Winning: I just, I think I, if I was to leave you with one thing, I would say start, start today.

Ask for help. You know, we get this question all the time you know, and, and I often some, like sometimes it's not the right fit. I might not be the right fit or it might not be the right fit, but I can find you the right fit. I can, I can, you know, connect you with somebody that is, you know, the type of planner that, that will help you get started.

But start. It's, no, it's not different than going to the gym or, you know, getting on, you know, healthy habits or a good eating plan. The sooner you start, the sooner your, you will see results and then it's just momentum and that takes over and that's so powerful.

Valerie LaVigne: Mm-hmm. I love that. It's so true. I, I joke and I tell people the best time to start a new habit was yesterday, but the second best time is today.

Lisa-Marie Winning: Oh, I love that. To do it. Mm-hmm. I'm gonna take that one. I hope you don't mind.

Valerie LaVigne: Yeah. Just switch. Just switch the wording to financial planning. I love it. Yep. Okay. Before our final segment of the show, let us know where we can find you, where we can follow you?

Lisa-Marie Winning: well you can find me on my website.

There's lots of information there about getting started and there's some there's some education on there too. And so it's winningandassociates.ca or you can find us on Instagram. And I have to thank you for that. You kind of helped to get us started and you're so great when it comes to that.

So we're @winningandassociates on Instagram.

Valerie LaVigne: Awesome. I'm gonna link to these in the show notes page for your episode, which will be available at valerielavignelife.com/lisa-marie. Okay. Rapid fire round. I'm gonna ask you four questions. Are you ready?

Lisa-Marie Winning: I am ready. This, I did not get these in advance.

Valerie LaVigne: No, nobody gets them in advance.

Lisa-Marie Winning: Oh, okay.

Valerie LaVigne: So the first question is, what are you currently reading or what is your favourite.

Lisa-Marie Winning: Okay, so I'm an avid reader. I read a lot for work, and so when I read, I read for pleasure. I love beach reads. I love suspense. So I love Ellen Hildebrand books. I've read every single one, and I'm patiently waiting for the next one to launch, and I think it's coming out in June.

Valerie LaVigne: Okay, cool. I'm gonna, I'm gonna link to this author in the, the show notes as well. Question number two is, what does empowerment mean to you?

Lisa-Marie Winning: Freedom. And that's, it's freedom to make choices freedom to help others, freedom to change your mind. It's, that's such a powerful word. And I feel like if, you know, because of the type of work that we do, if I can, you know, help empower someone to have that type of freedom, to be able to make choices in their life, that that's, that means success to.

Valerie LaVigne: I love that answer. That's fun. Question number three is, what is your longest standing habit?

Lisa-Marie Winning: Well, I, oh my gosh, my longest standing habit. I love fit. I, I do love fitness. And so maybe, I guess Pilates might be, I'm a, I'm an avid Peloton person now. I bike in the tread and I love it. And it's part of my daily routine.

But I would say that Pilates, I think I'm 16 or 17 years of a really avid reformer Pilates student. And how could we not talk about exhale for a minute? So that's, and that's how we met. Right. So it really has impacted my life in so many amazing ways, but that would be it.

Valerie LaVigne: Yeah. I love that. Yeah.

Lisa-Marie and I met at Exhale Pilates. Years ago, almost 10 years ago, I think. Yeah. So you've actually been doing Pilates longer than I have. Mm-hmm. Which is hilarious. But yeah, that's where we met and then the just evolved from there. I feel like we need a second episode about exhale.

Lisa-Marie Winning: Oh, I definitely, yeah.

Valerie LaVigne: Yeah. We should do that one. Okay. Final question. What are you currently working towards?

Lisa-Marie Winning: Well right now I am almost finished an executive program at Wharton. Wharton is a business school that's tied to the University of Pennsylvania. It's like, for those of you who don't know, and I'm really proud about this, so I'm gonna brag for a minute, but Wharton would be like the same like.

Caliber is like Harvard Business School or Yale Business School. So I am almost finished a program in like investor psychology and just behavioral trends in the industry and, and understanding how people make decisions, understanding family dynamics and, you know, it's really meant to. Generations of family you know, handle their wealth and educate their kids and protect that wealth.

So I'm, I'm really lucky to have have had the opportunity to be in this program. And I have one more kind of major milestone to go, and then I will be posting all about it.

Valerie LaVigne: Congratulations. That's so exciting. I had no idea.

Lisa-Marie Winning: Thank you.

Valerie LaVigne: That's awesome. Well, thank you again for being on the show. Like I said, it was long overdue, but I'm glad that we're having this conversation now.

It feels very irrelevant. It feels very empowering, and I hope that the listener will take away this this conversation as something to take action on and to start, even if they're 20, 30, 40, 50, wherever they're heading, believe is just get started in, in. Momentum building and that financial plan building.

So again, thank you so much. This has been incredibly valuable. I've learned a lot and I feel excited for what's next. And I'm so thrilled that you could be here and that I get to work with you. So thank you.

Lisa-Marie Winning: Thank you. I appreciate having been invited and this was a great chat. I really had fun.